Who Would Have Guessed? 2020 Caps Off Stellar Decade for Investors

To the average investor, 2020 was nothing short of confusing. While the global economy was devastated by the pandemic, stock markets rallied. The US S&P 500 index reached record highs as investors flocked to growth and technology stocks. Aided by exceptionally low-interest rates, government fiscal injections and rapid-fire vaccine development, most share markets recovered from the first quarter collapse to end the year in the black.

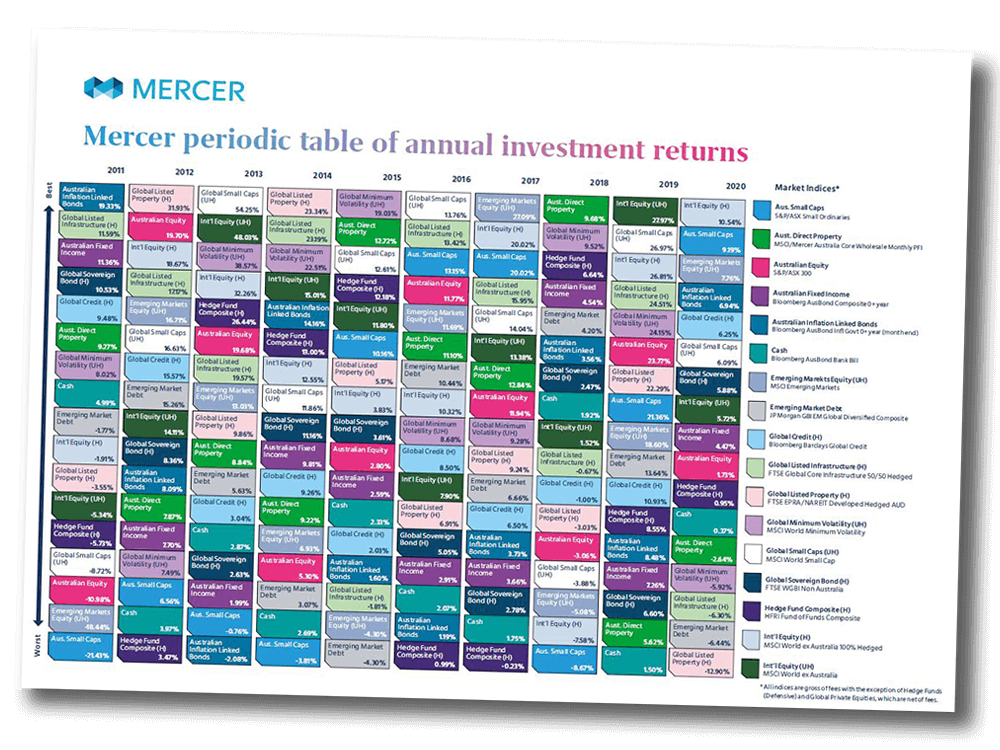

However, not all asset classes delivered the goods, as highlighted by Mercer’s ‘Periodic Table’ (the Table) of investment returns. Produced annually, the Table colour-codes 16 major asset classes and ranks how each performed on an annual basis over the last ten years.

A quick glance at the Table shows how one year’s winners can quickly become next year’s losers and vice versa. Predicting what may happen next poses a big challenge to even the most avid market followers and that the unpredictable nature of capital markets is unavoidable. The Table serves as a reminder to investors to establish their risk tolerances, avoid the temptation to pick winners, allocate to a range of asset types and focus on the longer term. In that way, there is a greater chance that periods of market disruption such as we saw in 2020 can be tolerated, rather than spark a panic reaction. With a well-constructed portfolio in place, the best advice during episodes of heightened volatility is often: Don’t just do something, stand there!

Key Observations:

Looking across 2020 and the past decade, a number of observations can be made from the Table:

- 12 of the 16 asset classes generated a positive return last year – a healthy proportion albeit beneath the 100% level achieved in 2019.

- Leading the way in 2020 was Global Private Equity (+14.9%) – an asset class not accessed by many investors but consistently a source of double-digit returns over the past decade, partly reflecting its higher risk and lower liquidity characteristics.

- Also high on the leader board last year was New Zealand Equities (+14.6%). As was the case for all share markets, February and March proved highly challenging as the reality of the spread of COVID-19 kicked in. However, the presence of Fisher and Paykel Healthcare and a range of utilities in the large cap space saw the NZX recover well by year-end.

- Our Australian cousins fared not quite so well in 2020, notwithstanding an incredible resurgence from deferred-payment company Afterpay, as a range of travel and energy-related stocks struggled.

- Further afield, global share markets generally delivered pleasing outcomes in 2020, including Developed Market, Emerging Market and Small Cap Equities. However, certain segments were an exception. Global Listed Property (-13.6%) and Global Listed Infrastructure & Utilities (-6.5%) feature at the bottom of the Table. The pandemic proved particularly troublesome for the profitability of businesses in the hotel and retail sectors.

- New Zealand and Global Fixed Interest (with the exception of Emerging Markets) delivered solid returns of +5.4% last year alongside a general fall in interest rates. . While it couldn’t compete with the riskier asset classes, fixed interest exposure gave a helpful boost for conservative investors.

- An aversion to risk was often prevalent during the year, but overall Cash proved an unattractive place to be as central banks pressured interest rates lower. The asset class generated a historically low return of +0.6% - a safe haven but not a path to riches!

- Across the decade, the award for single highest annual return remains with Emerging Market Equities (+34.6% in 2017).

- As a group, last year’s asset class returns comprised a top-to-bottom range of 29% – similar to the prior three years and to the average for the decade as a whole (32%).

Takeaways for Investors

For investors in diversified funds including KiwiSaver, a relatively narrow portfolio emphasising Shares and Bonds, with something of a domestic bias, proved hard to beat in 2020. However, it is too easy to conclude that simple is superior. With few asset classes standing out as obviously ‘cheap’ at present, the argument for wider diversification is perhaps as strong as ever. Exposure to non-traditional asset classes can serve to balance out the path of returns over time, so long as the risks are understood and access is attained on a cost-effective basis.

David Scobie is Head of Consulting NZ at global investment firm Mercer.

This article does not contain investment advice relating to your particular circumstances. No investment decision should be made based on this information without first obtaining appropriate professional advice and considering your circumstances.

18 March 2021