TAX

Any returns you make on your investment in the NZDF Savings Schemes are subject to tax. Mercer will deduct the appropriate amount from your account and pay it to Inland Revenue on your behalf (in some years you may see a tax refund).

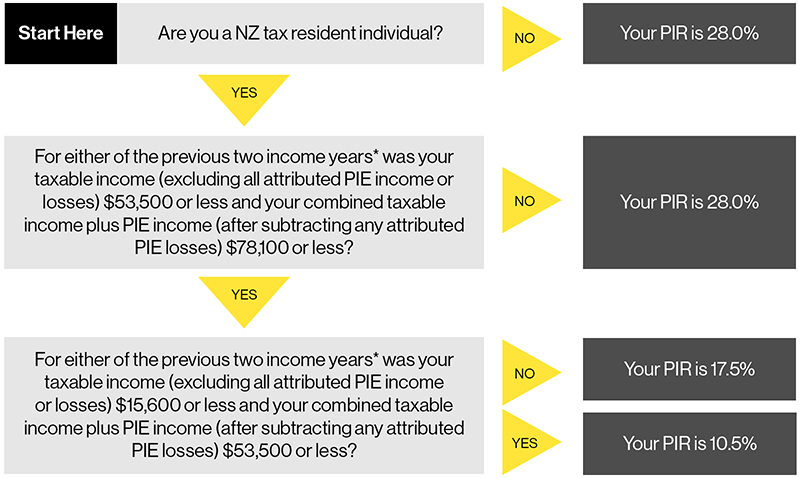

- The tax rate applied to earnings from your KiwiSaver, FlexiSaver or Defence Force Superannuation Scheme accounts is called Prescribed Investor Rate (PIR). The rate could be 10.5%, 17.5% or 28% (and also 0% in FlexiSaver), depending on your income for the previous two years. The earnings from these accounts are called income from portfolio investments entities (PIE’s).

- Mercer pays tax to Inland Revenue on your behalf, you don’t need to file a tax return for your Mercer retirement savings accounts.

- Inland Revenue undertakes a wash up calculation at each year-end. The PIE tax calculation is undertaken separately to the income tax calculation, as income tax rates can differ to the PIR. As part of this year-end calculation Inland Revenue will notify Mercer if you are on an incorrect PIR.

- Inland Revenue will determine the correct PIR that should have been used for the full tax year.

- If you have paid too much PIE tax, you'll have a PIE tax credit, which may be used to reduce any tax to pay on your other taxable income prior to any overpaid PIE tax being refunded to you.

- If you have not paid enough PIE tax, you'll have a PIE tax liability. If you have not used the correct PIR for the full tax year, liability will be included as part of your tax to pay on your other taxable income.

TAX RESIDENCY FOR NEW ZEALAND TAX PURPOSES

If you live and work in New Zealand, it's important to understand your tax residency status. Your tax residency status determines what taxes you'll pay in New Zealand, and it's important to get it right to avoid any potential issues with your PIE fund which can include KiwiSaver, Superannuation and Trust investments.

In New Zealand, you can either be classified as a New Zealand tax resident, or non-resident taxpayer. Your tax residency status is determined by a number of factors, including the amount of time you spend in New Zealand, your intentions for being in New Zealand, and your connections to the country.

It's important to note that your tax residency status can change over time. For example, if you initially come to New Zealand as a non-resident taxpayer but then decide to stay for a longer period of time, you may become a New Zealand tax resident. Similarly, if you're a New Zealand tax resident but then leave the country, you may become a non-resident taxpayer depending on your personal circumstances.

If you're a New Zealand tax resident, your PIR will be based on your taxable income for the previous two income years.

If you're a non-resident taxpayer, your PIR will be 28%. If you do not notify your PIE fund manager (in the case of NZDF KiwiSaver, NZDF FlexiSaver or NZDF Superannuation Scheme, you will need to notify Mercer), your income earned from the Scheme will be taxed at the default rate of 28%.

What is the process for determining my tax residency status?

You can determine your tax residency by visiting https://www.ird.govt.nz/international-tax/individuals/tax-residency-status-for-individuals

If you're still unsure about your tax residency status in New Zealand, it's a good idea to seek professional advice from a tax expert.

How do I advise of a change in my tax residency status?

To advise a change in your tax residency status, you will need to fill in the Notification of change of tax residency status form available on your online account. To log in click here.

It's important to keep your tax residency status up to date with Mercer to ensure that you are paying the correct amount of tax and complying with New Zealand tax laws.

Additional resources

- https://www.ird.govt.nz/international-tax/individuals/tax-for-non-resident-taxpayers

- https://www.ird.govt.nz/international-tax/individuals/tax-residency-status-for-individuals

- https://www.ird.govt.nz/-/media/project/ir/home/documents/forms-and-guides/ir200---ir299/ir292/ir292-2020.pdf?modified=20220426015430&modified=20220426015430

WHAT IS YOUR PRESCRIBED INVESTOR RATE (PIR)?

You can work out your PIR by clicking here. Alternatively, please refer to the PIR table below.

Update Your PIR online

To check or update your PIR, log in to your account online or via NZDF Savings Schemes App.

To update the PIR online:

- Login and click - 'personal details' on the top right corner.

- Scroll down, and you can see your current PIR rate; as well as selecting your new PIR with rate effective date.

- If your PIR is correct then you don't need to do anything.

- Click ‘submit’ to complete the changes if you need to update your PIR.

*Previous two income years refers to the two years prior to the tax year that the PIR is being applied to. An income year is generally the period from 1 April to 31 March of the following year. However, an income year can start and end on alternative dates if Inland Revenue consents. The tax year is always the period from 1 April to 31 March of the following year.