Does the Scheme hold your correct PIR?

Tax on your Investment

Any returns you make on your retirement savings are subject to tax. Mercer, as the Manager, deducts the appropriate amount from your account and pays it to Inland Revenue on your behalf.

It’s up to you to tell us how much to pay

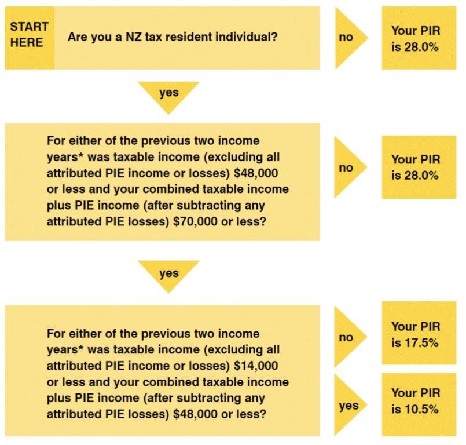

The tax rate applied to earnings from your Defence Force Superannuation Scheme, New Zealand Defence Force KiwiSaver Scheme and New Zealand Defence Force FlexiSaver Scheme accounts is called your Prescribed Investor Rate (PIR). It could be 10.5%, 17.5% or 28%, depending on your income for the previous two years.

Because Mercer pays the tax payments to Inland Revenue on your behalf, you don’t need to file a tax return for your retirement savings accounts; unless you’ve nominated the wrong rate.

Get your rate right

Choosing the wrong PIR can have significant consequences, so it's best to get it right.

- If you don’t provide your IRD number and your PIR, highest 28% rate will apply.

- If you nominate a rate that is higher than it should be, you’ll pay too much tax and cannot claim the extra tax back.

- If your notified rate is too low, you will need to pay any tax shortfall (plus potential interest and penalties).

- 2021 tax year end onwards, IRD will notify the correct PIR based on personal income, and providers LIKE Mercer must update the PIR accordingly;

- 2021 tax year end onwards, overpaid PIE tax may be refunded. Underpaid PIE tax is included in the year end tax calculation of the member and the member will be required to pay the shortfall;

- If you are a new resident, when you work out your PIR, you must include non-New Zealand sourced income for that particular income year – even if you weren't a tax resident in New Zealand when the income was earned. You may elect out of this treatment in some cases, visit Inland Revenue's website www.ird.govt.nz to find out more.

To check or update your PIR, log in to your account.

If your PIR is correct then you don't need to do anything!

If you're not sure what your tax rate should be, you can work out your correct PIR by using the table below.

Children in KiwiSaver

Most children in KiwiSaver and FlexiSaver will meet the criteria for the lowest PIR of 10.5%. You can make significant savings on your child’s behalf if you update their PIR.

Questions?

Call us on 0800 333 787. You can find more information on the Inland Revenue website.

Important: Please note that any information in this material regarding legal, accounting or tax outcomes does not constitute legal advice or an accounting or tax opinion and prior to relying and acting on this information it is important that you seek independent advice from a qualified lawyer or an accountant regarding this information.

5 November 2020