PIR changes effective 1 April 2025

Overview

Effective 1 April 2025 (and as announced in Budget 2024) the income ranges for determining the Prescribed Investor Rate (PIR), a rate at which an investor pays tax on their share of taxable investment income from a Portfolio Investment Entities (PIE) investment, are changing.

These changes are linked to the personal income tax changes that took effect on 31 July 2024 and have reduced personal income tax for all people receiving over $14,000 a year in taxable income[1].

The New Zealand Defence Force KiwiSaver Scheme, FlexiSaver Scheme and Defence Force Superannuation Scheme are PIE’s and therefore you may be impacted by the changes.

To find out how PIR’s work click here.

New income tax thresholds

The thresholds that apply from 1 April 2025 are:

Taxable income |

Taxable income plus PIE income |

Rate |

$15,600 or less |

$53,500 or less |

10.5% |

$53,500 or less |

$78,100 or less |

17.5% |

$53,501 and over |

$78,101 or more |

28% |

What does this mean for you?

Even if your salary hasn’t changed, you may be impacted by the changes in income tax thresholds and you may need to advise your PIE fund manager (in the case of NZDF KiwiSaver, NZDF FlexiSaver or NZDF Superannuation Scheme, you will need to notify Mercer) of a new PIR.

Is there anything I need to do?

It is essential to review your PIR at least once annually or whenever your circumstances change. Given the changes, now is also a great time to assess and update your PIR, if necessary. To ensure you are taxed correctly on your PIE fund(s), you must first determine your PIR. After establishing your PIR, you must advise of changes to your PIR to your PIE fund manager, in this case Mercer, along with your IRD number (if we don’t have it already recorded). You can log in to your account at https://www.nzdfsavings.mil.nz/ to view what PIR we have recorded for you and whether we have your IRD number.

Work out your PIR

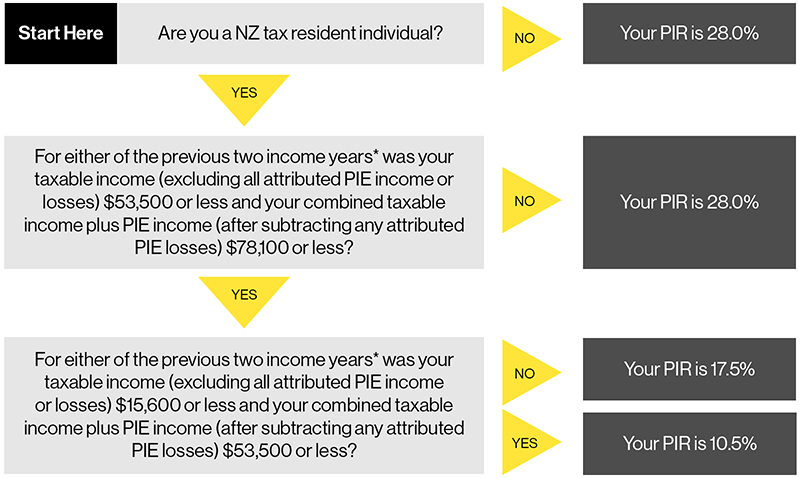

You can work out your PIR using the below chart or by using the PIR calculator.

[1]The Government deferred the corresponding PIR changes until 1 April 2025 to minimise compliance costs.

Inland Revenue’s role

Inland Revenue [IR] monitors your earnings, and if your PIR changes due to fluctuations in your earnings, they will inform you, as well as Mercer of your new PIR. We are required to update your PIR if advised by either you personally or by IRD.

If I advise Mercer of the wrong PIR?

It is your responsibility to keep Mercer updated of your correct PIR. Advising Mercer of the wrong PIR may mean:

- The PIR is higher than it should be: IR will undertake a wash up calculation and if you have paid too much PIE tax, you'll have a PIE tax credit, which may be used to reduce any tax to pay on your other taxable income before any overpaid PIE tax is refunded to you by IR.

- The PIR is lower than it should be: IR will calculate the outstanding PIE tax liability and this will be included as part of your tax to pay on your other taxable income.

A trust (other than a unit trust or charitable trust) that invests in a PIE may be able to receive similar tax advantages as an individual with a taxable income exceeding $53,500, provided the PIE reports a Prescribed Investor Rate (PIR) of 28%.

A trust has the option to either retain the income generated from a PIE within the trust or distribute it to its beneficiaries.

If income from a standard savings account is retained and taxed within the trust as trustee income, it will be subject to the trustee income tax rate of 33% or 39% if the trustee income exceeds $10,000 per year (with the exception of certain superannuation funds, which are taxed at a rate of 28%).

PIR for Trusts

Resident Trustees (excluding tax charities) that have provided the trust's IRD number can choose a PIR of:

- 28% as a final tax, or

- 17.5% and include the income and tax in the trust return, or

- 10.5% for trustees of a testamentary trust and include the income and tax in the trust return, or

- 0% and have the income included as trustee/beneficiary income.

A trust has the option to either retain the income generated from a PIE within the trust or distribute it to its beneficiaries.

Trustees choosing a PIR of 0% allows the tax credits as well as the attributed income to flow through to the trust return. If the tax credits are insufficient to cover the tax liability on the trust income, either as trustee or beneficiary income, the trust will need to pay the extra tax.

If a trustee chooses a 28% PIR the PIE income is excluded income and is not included in either the trust or beneficiaries' taxable income in their tax returns.

How to update your PIR

To update your, you will need to log in to your online account and navigate to the

- Login and click 'personal details' on the top right corner

- Scroll down, and you can see your current PIR rate, check if Mercer holds your IRD number and select your new PIR with effective date if necessary;

- If your PIR is correct then you don't need to do anything.

- Click ‘submit’ to complete the changes if you need to update your PIR.

Helpful resources

- https://www.ird.govt.nz/kiwisaver/kiwisaver-individuals/taxing-kiwisaver-income

- https://www.ird.govt.nz/income-tax/income-tax-for-individuals/types-of-individual-income/portfolio-investment-entity-income-for-individuals/prescribed-investor-rates/find-my-prescribed-investor-rate

- https://www.ird.govt.nz/roles/portfolio-investment-entities/multi-rate-pies-and-prescribed-investor-rates

The treatments described in this article are based on our understanding of New Zealand tax legislation as it applies to the Scheme. Tax legislation, its interpretation and the rates and bases of taxation are subject to change. The application of tax laws depends on a member’s individual circumstances. Members are advised to seek their own tax advice from a qualified tax adviser. This information has been prepared by Mercer (N.Z.) Limited for general information only. The information does not take into account your personal objectives, financial situation or needs.

28 March 2025